Bill would tax Michigan trucks by the mile

Michigan lawmakers’ plans to tax trucks per mile and hike their bridge tolls would raise costs for consumers with no guarantee roads would improve.

In addition to Michigan’s gas tax and vehicle fees, state lawmakers are considering charging truckers a new tax on each mile driven and higher tolls on bridges.

The taxes won’t stop at the trucking companies, but rather get passed along to consumers as higher prices.

Drivers would be taxed 6 cents per mile on any truck weighing 26,000 pounds or more under House Bill 4779, introduced in June 2019 by House Democratic Leader Christine Greig of Farmington Hills. It also opens the door to government tracking of vehicles.

A bridge toll that applies only to trucks would be created under another bill introduced at the same time, House Bill 4780. This is similar to a law passed in Rhode Island last summer, which is now facing legal challenges. The American Trucking Associations and three motor carriers are suing Rhode Island claiming tolls targeting truckers are a violation of the U.S. Constitution’s Commerce Clause.

“This toll regime was designed to, and does in fact, impose discriminatory and disproportionate burdens on out-of-state operators and on truckers who are operating in interstate commerce” the lawsuit states. “By design, the tolls fall exclusively on the types of trucks that are most likely to be engaged in the interstate transport of cargo while exempting automobiles and the smaller vehicles that are relatively more likely to be engaged in intrastate travel.”

Higher costs on cargo transport means higher prices paid by the public for that cargo.

Greig argues that charging trucks more for miles driven and bridge tolls is paying for use. “(Michigan residents) want everyone to pay their share for the infrastructure we all use,” she said in prepared remarks. “They want accountability for those that cause the most damage to our roads.”

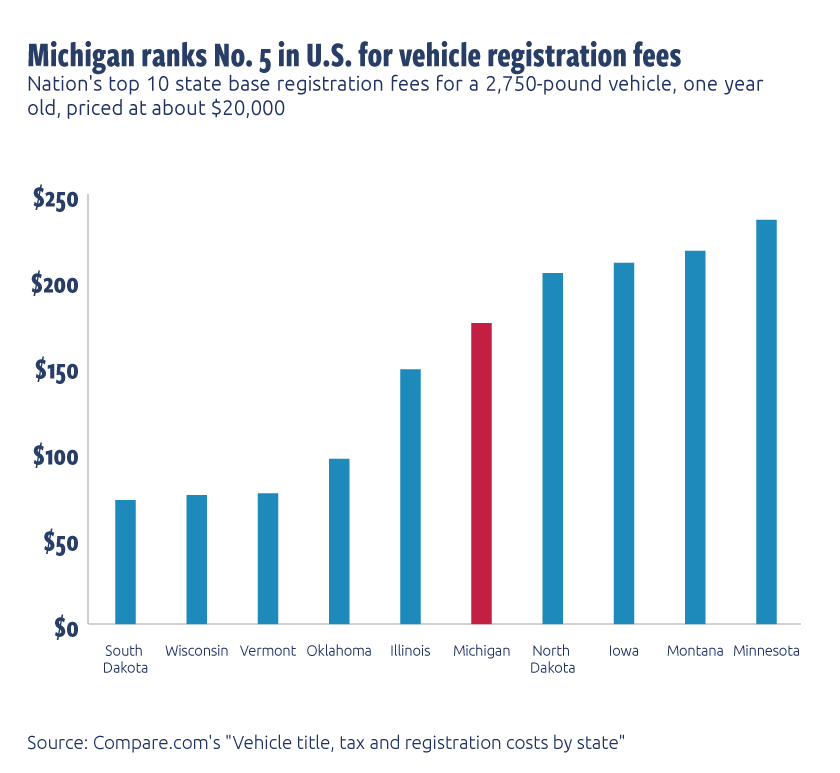

Michigan vehicle fees are already among the highest in the nation while its roads rank as the nation’s worst.

Being forced to pay an additional 6 cents per mile is a financial burden for truckers that would inevitably be passed along to the consumer.

Independent truckers oppose both the mileage tax and higher tolls, said Mike Matousek, manager of government affairs for the Owner-Operator Independent Drivers Association. Plus, Michigan has a history of taking funds earmarked for roads and diverting them to other projects.

“…Revenue generated from fuel taxes must be spent on the construction and maintenance of roads and bridges, and not diverted to non-transportation projects. If a legislative proposal doesn’t meet this standard, there’s simply no way we’ll support it. In fact, we’ll aggressively oppose it,” Matousek said.

Taxing trucks more per mile and more per bridge crossing are ideas that should stall in the legislature. Hiding taxes as higher costs to consumers is as dishonest as taxing for roads and then spending the money elsewhere.