Michigan personal income growth beats every surrounding state since passing right to work

Even with recent weaknesses due to the auto strike, the Wolverine State has seen roaring income growth since enacting right to work in 2013.

Michigan has been home to the best economic growth in the region over the past decade.

And it’s clear tax and labor reforms have helped drive that success.

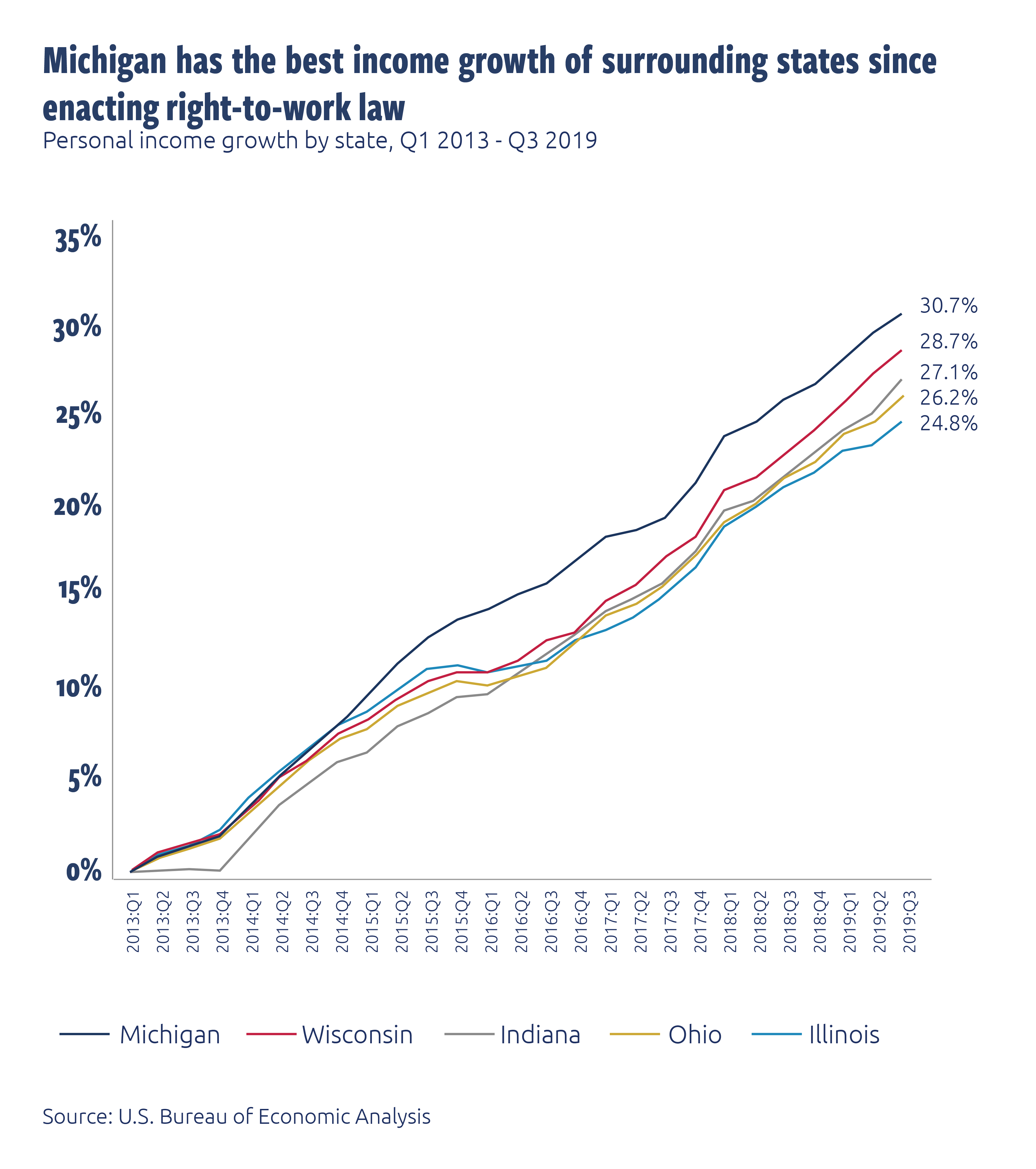

Case in point: Since Michigan’s right-to-work law took effect in March 2013, Michigan’s personal income growth has outpaced every surrounding state – even after accounting for a recent slowdown due to the auto worker strike.

Data from the Bureau of Economic Analysis show Michigan personal income has jumped nearly 31% since 2013, beating out Wisconsin (28.7%), Indiana (27.1%), Ohio (26.2%) and Illinois (24.8%).

Michigan should look to what drove its last decade of success to chart a course for its future.

Locking in gains and spurring further growth

Michigan has an opportunity to lock in additional tax reforms now that government revenues are strong. Unfortunately, Gov. Gretchen Whitmer has signaled support for a progressive income tax hike.

Progressive taxes are a strategy that other states have been rejecting and that damaged the economy in Connecticut, the only state to move to the system in the past 30 years. One Michigan activist group is pushing to get a $1.5 billion progressive income tax hike on the ballot in 2020. The only other state in the region moving toward a more progressive income tax scheme is Illinois.

Whitmer has also advocated for a major increase in Michigan’s gas tax to fund more road construction. Michigan has been funding updates to its transportation network with general fund sources, so any gas tax increase should be coupled with an equivalent decrease in the state’s sales tax rate so that Michigan taxpayers are not paying more in total tax. While it makes sense to fund roads with motor fuel taxes, it does not make sense to hit Michiganders with a tax hike.

Michigan took a positive step on the tax front in 2015 by exempting new business tangible personal property from taxation. This is a smart change because business tangible personal property taxes are a tax on machinery and equipment placed in service in Michigan. Policymakers can round out this reform by exempting all existing tangible personal property from taxation in Michigan, not just new purchases.

But Michigan’s tax law still punishes new business investments in machinery and equipment by not allowing investments to be fully deducted as business costs in the year they are purchased.

The most important change to fix this would be to provide for full and permanent expensing for business investments made in Michigan. This can be done by permanently adopting Section 179 and Section 168(k) expensing provisions from the federal tax law. Even though Michigan’s business tangible personal property taxes are being phased out, Michigan still discriminates against investments in machinery and equipment by preventing businesses from deducting the full cost of those investments when they calculate their business income in Michigan. Providing fair treatment for deducting investment costs is a proven tool to bring increased investment, jobs and growth.

Growth has slowed with auto industry

Michigan personal income grew at a 3.3% annual rate in the third quarter of 2019, below the national average of 3.8% and trailing neighboring states. Michigan’s growth in economic activity (GDP) and personal income have slowed in the past two years after a booming recovery from the Great Recession. A secular slowdown in the auto sector and the recent auto labor strike have played a role in Michigan’s broader slowdown.

Michigan’s Q3 2019 personal income growth of 3.3% trailed neighbors Wisconsin (4.0%), Illinois (4.3%), Ohio (4.4%) and Indiana (5.9%).

Michigan particularly lagged surrounding states in net earnings growth, which includes wages, salaries, and self-employed income. Michigan’s growth of 4.0% trailed Wisconsin (4.9%), Ohio (5.3%), Illinois (6.5%) and Indiana (7%). Michigan was also the only Great Lakes State to see a decline in earnings for durable goods manufacturing, and saw the region’s steepest decline in finance and insurance earnings over the quarter.

Policy mistakes like reversing labor reforms, adopting an uncompetitive progressive income tax regime, and failing to fix how the state treats business investments risks derailing the Michigan growth story.

With smart reforms, Michigan can not only lock in the successes of the past decade, but also attract investment that will build toward stronger growth for families across the state going forward.