4 reasons to reject a $1.5B progressive income tax hike in Michigan

The progressive income tax proposal would harm middle-class families and Michigan’s economy, not to mention hand over enormous new taxing power to the governor’s office.

A new group started by Democratic activists will soon begin circulating petitions to remove Michigan’s constitutional flat income tax protection, and replace it with a progressive income tax.

They’ll need to collect 425,000 signatures from voters by July 6 to get their question on the ballot and a simple majority vote in November to make it law.

At first glance, the proposal might seem appealing to some Michigan voters.

But a closer look reveals serious problems.

The progressive tax plan hands an additional $1.5 billion to state government by hiking taxes on individuals making more than $175,000 a year (or joint filers making more than $350,000). It also would mandate an income tax cut for people making less than that – though it’s not clear how large or small the tax cut would be.

And that’s where the cracks start to show.

There are four major problems with this plan, which proponents are dubbing the “fair tax”:

- The plan would give Gov. Gretchen Whitmer – and subsequent governors – the power to set tax rates unilaterally, without voter or lawmaker approval.

- Scrapping the flat income tax protection would open the floodgates for middle-class tax hikes.

- It would harm Michigan workers and the state economy at large. Results in other states show progressive income tax hikes cause wealth and investment to leave for greener pastures.

- Michigan’s income tax is already fairly progressive. High-income residents pay roughly five times the share of their income in state income taxes compared with lower-income residents.

Michigan voters have rejected switching from a flat to a graduated income tax three times in state history, by at least 2-to-1 margins in every case. So before voters confront a canvasser seeking their signature, they should know the truth about what this new progressive income tax proposal would really mean.

1. The governor would set tax rates by executive order

This “fair tax” proposal incudes an unfair, anti-democratic power grab that appears to be the first of its kind in the US.

The amendment doesn’t specify particular income tax rates. Instead, it sets a revenue target of $1.5 billion and requires the state to reduce tax rates for individuals making less than $175,000 and joint filers making less than $350,000. It also requires that the state impose marginal tax rates that increase with income.

But instead of allowing the General Assembly to pass the new income tax rates, which the governor can veto or sign into law, the proposal hands immense power over to the governor’s office.

Under the progressive income tax, if the governor and legislature don’t agree to new rates by June 1, 2021, the governor can simply impose new rates by executive order.

Specifically, the proposal reads, “If the legislature and governor fail to enact and sign the legislation … the governor shall enact by executive order a fair individual income tax,” and further, “the legislature does not have the authority to reject or amend that executive order.”

Much like Gov. Gretchen Whitmer’s decision to push a $3.5 billion borrowing plan through an unelected state board, the progressive tax amendment would allow Whitmer and subsequent governors to impose major tax changes without any approval from state lawmakers or voters.

2. It will bring about middle-class tax hikes

The promise of a progressive income tax is to soak the rich. But by removing Michigan’s flat income tax protection, it leaves everyone exposed to higher tax rates, especially the middle class. In fact, the proposal’s guaranteed income tax cut for people making under $175,000 expires in 2025.

The reason why progressive income taxes lead to middle-class tax hikes is simple: politics.

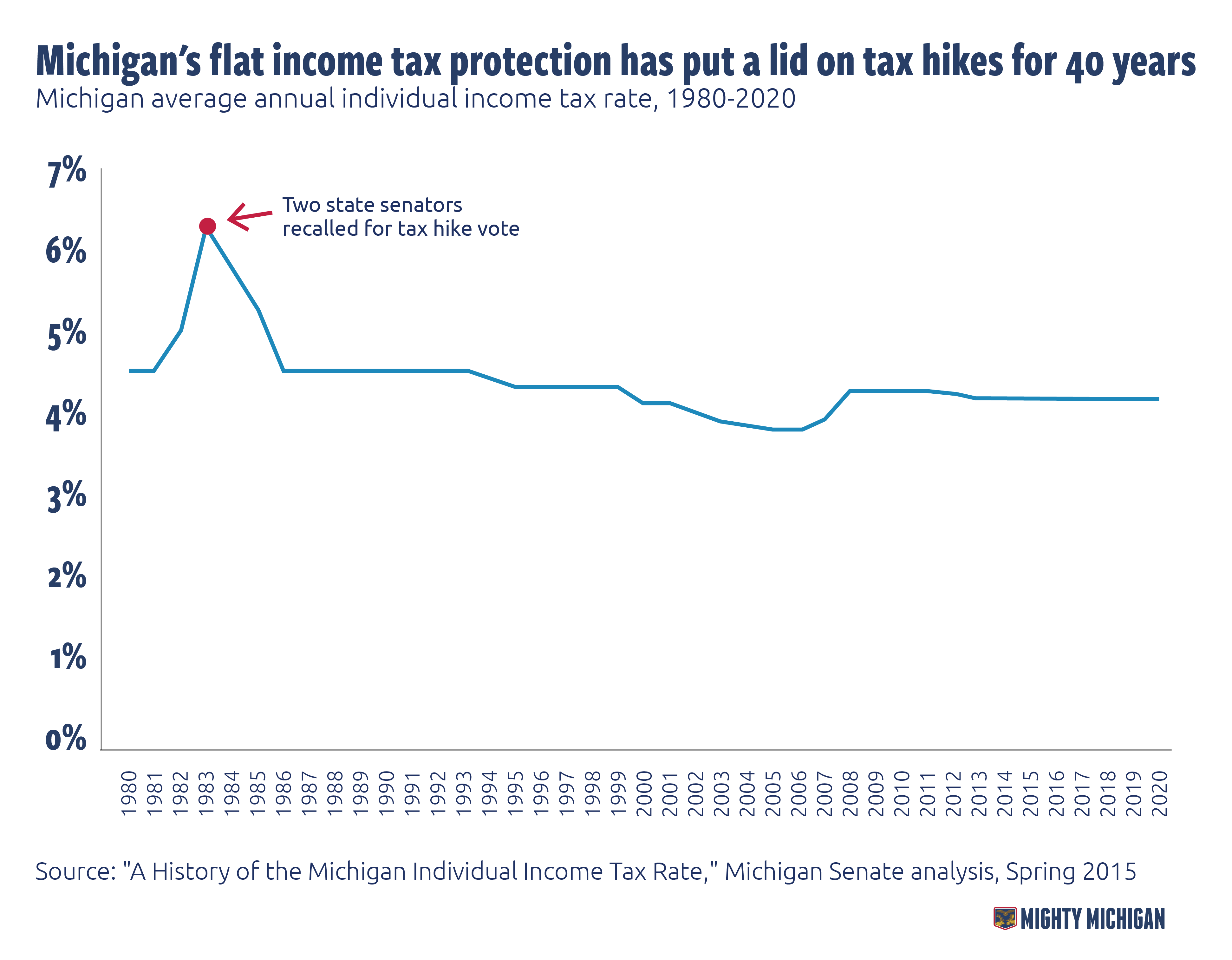

It’s very difficult for Lansing to raise income taxes on everyone at once. In fact, two Michigan state senators were recalled for their income tax hike votes in 1983. That backlash spurred income tax cuts, and Michigan has had an income tax rate below 5% for nearly 35 years since those cuts took effect.

Progressive income tax powers, on the other hand, allow lawmakers to slice up the electorate into multiple income brackets, minimizing voter backlash while eventually hiking taxes on everyone.

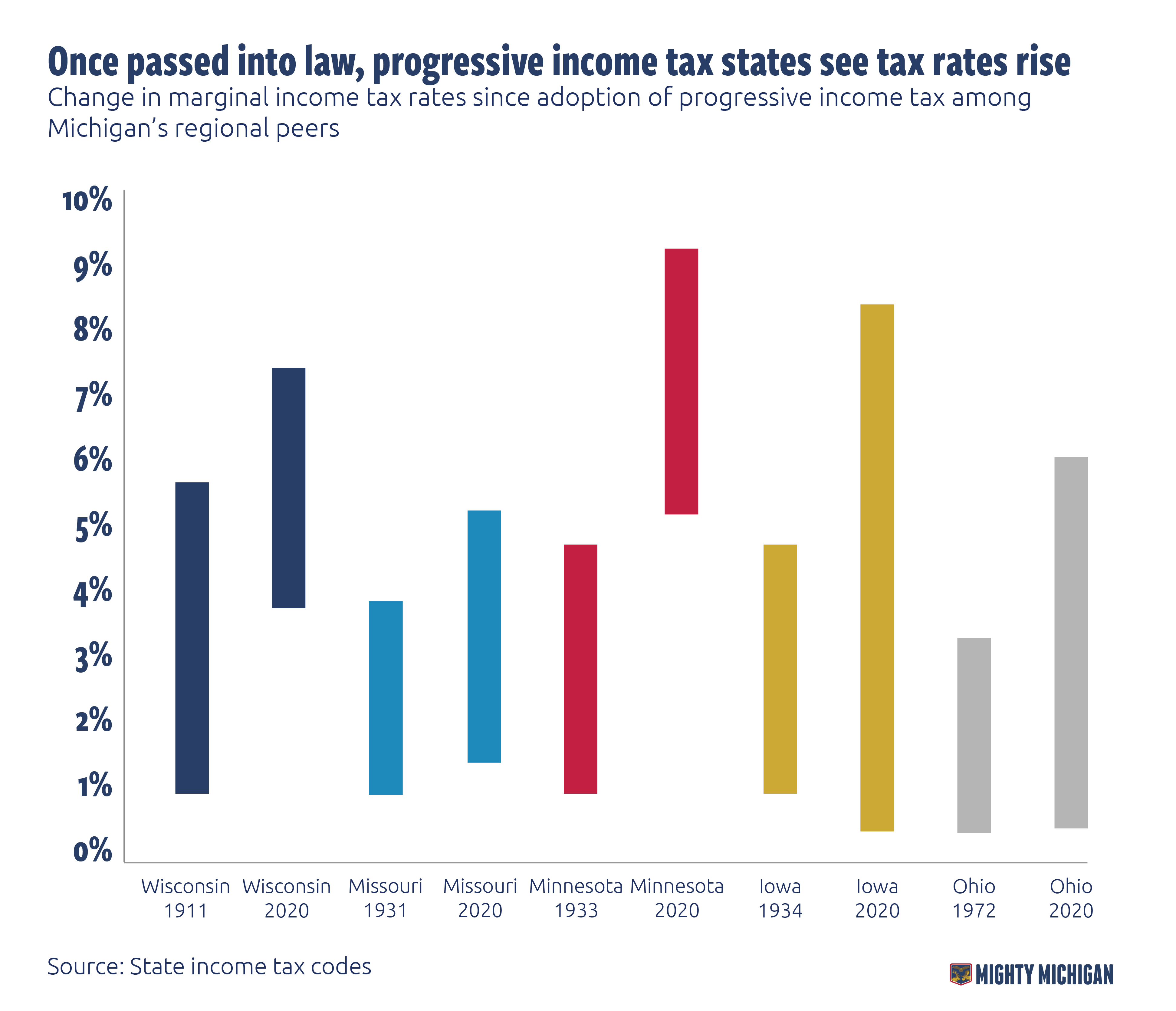

Just take Minnesota. Lawmakers there passed a progressive income tax in the 1930s. At first, the progressive tax imposed a top marginal tax rate of 5% on the richest residents in the state. Today, the lowest-income families in Minnesota pay an even higher rate than the rich did – with the lowest marginal tax rate kicking in at 5.35%.

In Missouri, another progressive income tax state, the highest marginal income tax rate of 5.4% kicks in on individuals making just over $8,400 a year.

3. It would punish Michigan workers and harm the economy

With observers warning of an American downturn, Michigan should be talking about broad tax cuts, not a tax hike totaling $1.5 billion.

It’s not surprising that states are increasingly moving toward lower and more flat income tax regimes. Colorado voters rejected a progressive income tax in 2018. Massachusetts voters have rejected a progressive income tax five times, by wide margins. And North Carolina and Kentucky flipped from progressive income taxes to flat income taxes within the last decade.

In fact, only one state has switched to a progressive income tax from a flat tax in the last three decades: Connecticut. And the results have been disastrous for poor and working class families.

As a local public radio station put it last year, “Despite Progressive Income Tax, Connecticut’s Poor Still Get ‘Clobbered’ By Taxes.” In fact, after adopting a progressive income tax, the poverty rate in Connecticut rose 47% while the poverty rate in other states fell by 10%, according to data from the U.S. Census Bureau.

The only other state in the nation with a progressive income tax on the ballot in November is Illinois, where residents already pay the highest taxes in the nation, according to a recent WalletHub study.

That’s not the example Michigan should be following.

A 2019 study from Stanford University researchers showed how a progressive income tax hike can backfire badly. The likelihood of a wealthy resident leaving California jumped by 40% after voters in 2012 approved a progressive income tax hike targeted at high-income earners. That wealth flight and other economic responses ended up wiping out nearly half of the expected new revenues from the tax.

New York also learned this lesson the hard way.

A federal cap on the State and Local Tax deduction in 2017 exposed high-tax states to the full consequence of their progressive income tax burdens. This caused a severe drop in income tax revenue in New York, as high-income earners moved their money elsewhere.

“People are mobile, and they will go to a better tax environment,” said New York Gov. Andrew Cuomo. “That is not a hypothesis, that is a fact. People act in their own economic interest. Businesses act in their own economic interest …”

“Tax the rich, tax the rich, tax the rich,” Cuomo said. “We did. Now, God forbid, the rich leave.”

4. Michigan’s income tax is already progressive

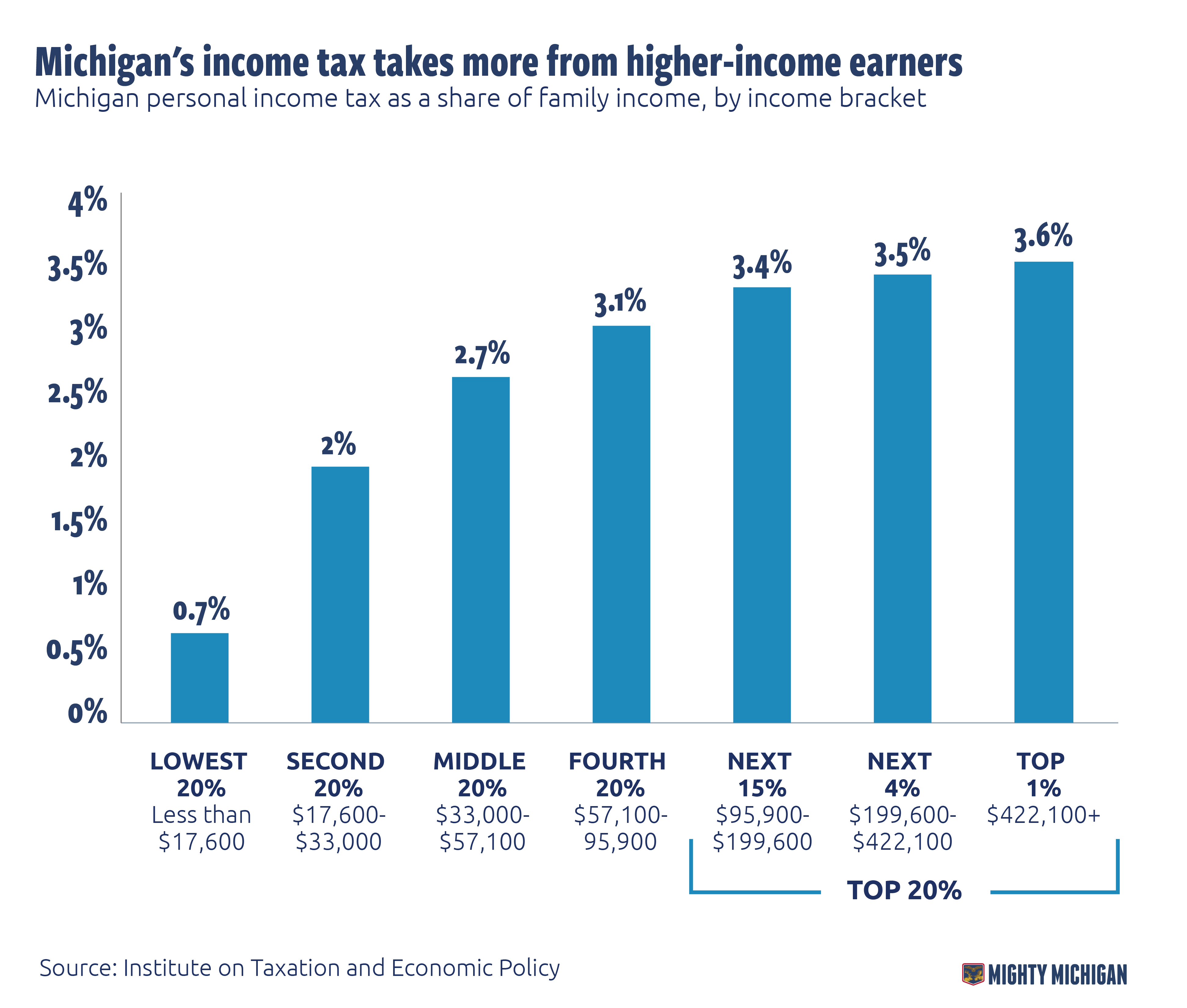

Michigan residents pay essentially no income taxes on earnings below $16,000 per year. That provision, among others, means Michigan’s income tax structure already takes more from the wealthy than from the poor, measured as a share of their income.

According to a 2018 study by the left-leaning Institute on Taxation and Economic Policy, the top 20% of Michigan households – people making $95,900 or more – pay an average of 3.4% to 3.6% of their income toward state income taxes.

That’s five times higher than the bottom 20% of earners, who pay 0.7% of their income in income taxes, on average.

There’s no doubt that well-branded progressive income tax proposals can gin up broad support, but basic errors and bad timing could tank the Michigan “fair tax” before it even gets off the ground.

Michigan voters have proven time ad time again that they can see through lofty promises and political rhetoric.

They would be wise to do so again.

— Sign the petition —

Reject the Progressive Income Tax Proposal

Protect Michigan small business experiencing severe hardship.

Learn More >